Do you have employees working in Norway? Employers falls under strict rules and regulations in Norway and there are many obligations to adhere to. Foreign enterprises with business activities in Norway must declare employment and income information for their employees using an A-report (A-melding). This also applies to employees who are non-taxable to Norway. All foreign contractors must report information in the Assignment and employee register.

What is A-report?

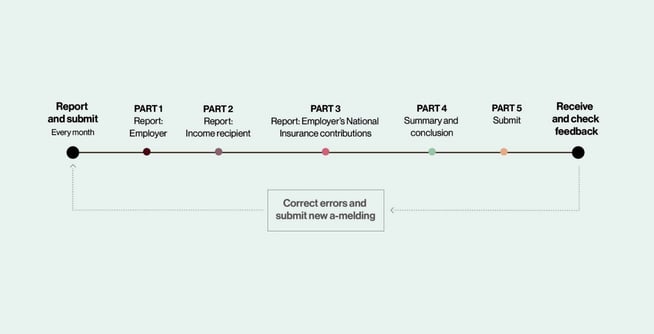

A-report is a mandatory monthly report in Norway where employers provide information to the Norwegian authorities about employees' income, employment, tax deductions, and National Insurance contributions. It ensures accurate reporting for payroll, taxes, and social security.

The purpose of A-report is to streamline and centralize reporting to the Norwegian authorities by employers and ensure:

- Accurate tax and social security calculations.

- Efficient data sharing between the Tax Administration, Nav (welfare administration), and SSB (statistics Norway).

- Reduce administration for employers and help them meet legal obligations

Also read: What is an A-report: A guide for employers in Norway

What must be reported on the A-report?

The A-report should contain information about the following:

- salaries

- pension

- remunerations

- tax deducted

- employments in the given period

- As a result of changes to Section 7 of the OTP Act effective from 1 January 2021, the employer has a duty to provide information in the A-report concerning whom they have entered into an occupational pension agreement with.

Status of employment must be declared, even if the employees have not received a salary/remuneration.

An income recipients’ leave of absence must also be declared if it continues for 14 days or more. Both paid and unpaid leave of absence must be declared.

How do you submit the A-report?

The A-report is submitted through the tax office web page. This is new solution for direct registration of the A-report. This is a solution called A10. (Previously the A-report was submitted trough Altinn. This is no longer possible for 2024).

The A-report can be submitted in one of the following ways:

- An accountant, advisor, solicitor, or another representative with access can submit the A-report for you- A10.

- You can register the A-report directly by using the A 10 form.

- You can submit the A-report from a payroll system integrated with the A10 system.

- You can submit the A-report in the new solution, called A10.

The A-report is sent from the legal unit (organization) registered in the Register of Legal Entities. Consequently, the system can only be used if the enterprise has applied for and received a Norwegian organization number.

Also read: A brief guide to your Norwegian tax return

Due dates

The A-report must be submitted by the 5th of the month after the payouts were made. The deadline is the next working day if the 5th is a Saturday, Sunday, or public holiday.

Example: Information about salaries paid out on the 21st of March must be submitted on or before the deadline, on 5th of April. It does not matter if these salaries are March salaries or payments in arrears for February. The A-report submission deadline is determined by the payout date.

The employer can submit the A-report as often as they want. This is usually done if they have several payout dates in a month.

Note that tax amounts must be transferred to the tax office bi-monthly within the 15th of the following tax period.

Also ready: Do the right things when doing business in Norway

Feedback from tax office

The tax office carries out automatic checks for every A-report that is submitted.

The feedback states what was reported and highlights errors which must be corrected. The feedback also contains information on payments of the employer`s National Insurance contributions and payroll withholding tax, accountant number, and KID number. It is therefore important to check the feedback.

Source: Guidance - Direct registration of a-melding in Altinn